Ensuring Security: Trust Foundations for Your Building Needs

Ensuring Security: Trust Foundations for Your Building Needs

Blog Article

Protecting Your Possessions: Depend On Foundation Expertise at Your Fingertips

In today's complex monetary landscape, making sure the protection and development of your assets is extremely important. Trust foundations act as a keystone for guarding your riches and heritage, offering a structured technique to asset defense. Competence in this world can provide important support on navigating lawful intricacies, making best use of tax obligation efficiencies, and developing a robust monetary plan customized to your distinct demands. By using this specialized knowledge, people can not only secure their possessions effectively yet also lay a solid foundation for long-lasting riches conservation. As we explore the intricacies of count on structure experience, a globe of opportunities unfolds for fortifying your financial future.

Importance of Depend On Structures

Trust structures play an important role in establishing credibility and cultivating strong partnerships in numerous professional settings. Depend on structures serve as the foundation for honest decision-making and transparent interaction within organizations.

Benefits of Specialist Guidance

Building on the foundation of depend on in specialist relationships, seeking professional advice provides very useful advantages for people and companies alike. Professional support supplies a wealth of expertise and experience that can aid browse complicated economic, legal, or calculated obstacles effortlessly. By leveraging the expertise of specialists in numerous fields, individuals and companies can make enlightened choices that line up with their goals and desires.

One substantial benefit of expert guidance is the capacity to gain access to specialized understanding that may not be conveniently available otherwise. Specialists can use insights and viewpoints that can cause ingenious solutions and opportunities for development. Additionally, functioning with professionals can help minimize dangers and uncertainties by supplying a clear roadmap for success.

Additionally, expert support can save time and sources by improving procedures and preventing costly errors. trust foundations. Professionals can use customized suggestions tailored to details requirements, making certain that every decision is educated and tactical. On the whole, the benefits of professional guidance are diverse, making it Recommended Site a beneficial possession in safeguarding and maximizing possessions for the long-term

Ensuring Financial Safety And Security

Ensuring economic security includes a multifaceted technique that encompasses different facets of riches monitoring. By spreading financial investments throughout various possession classes, such as stocks, bonds, actual estate, and products, the risk of substantial economic loss can be minimized.

Additionally, maintaining an emergency fund is vital to protect against unanticipated expenditures or income interruptions. Experts recommend establishing apart 3 to 6 months' worth of living expenditures in a fluid, conveniently obtainable account. This fund serves as a monetary security internet, providing satisfaction throughout stormy times.

On a regular basis assessing and adjusting economic plans in reaction to transforming circumstances is likewise vital. Life occasions, market variations, and legislative adjustments can affect financial security, emphasizing the value of recurring analysis and adaptation in the quest of long-term financial protection - trust foundations. By implementing these approaches thoughtfully and constantly, people can fortify their financial ground and job in the direction of a much more safe and secure future

Guarding Your Properties Effectively

With a solid foundation in location for economic security through diversity and reserve maintenance, the following essential action is securing your properties effectively. Guarding properties entails securing your riches from potential threats such as market volatility, economic recessions, claims, and unanticipated expenditures. One effective approach is property allocation, which entails spreading your investments across numerous property courses to minimize threat. Expanding your profile can assist minimize losses in one location by balancing it with gains in one more.

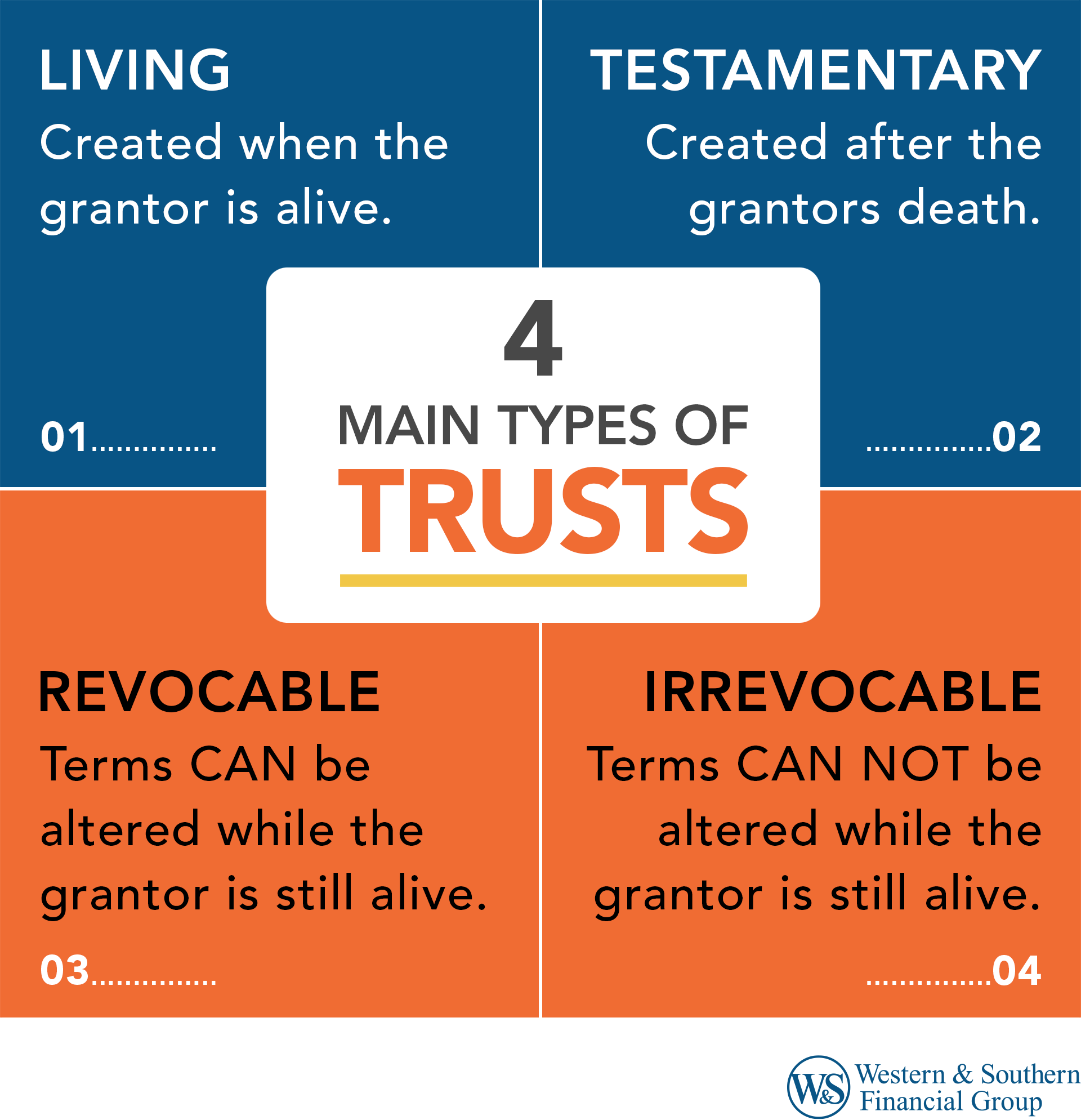

In addition, establishing a trust can supply a protected way to Homepage secure your possessions for future generations. Trust funds can help you control just how your properties are dispersed, minimize inheritance tax, and shield your wide range from lenders. By executing these techniques and seeking specialist advice, you can protect your assets successfully and secure your economic future.

Long-Term Asset Security

To ensure the long-term safety of your riches versus prospective dangers and unpredictabilities with time, critical planning for long-term possession security is essential. Long-lasting property defense entails applying procedures to protect your properties from different threats such as financial recessions, legal actions, or unexpected life events. One essential facet of long-lasting possession protection is developing a trust fund, which you can look here can supply considerable advantages in shielding your possessions from lenders and legal disputes. By moving possession of possessions to a trust fund, you can secure them from potential threats while still preserving some level of control over their monitoring and circulation.

In addition, expanding your financial investment portfolio is an additional key method for long-term asset protection. By taking a positive approach to long-lasting property protection, you can safeguard your wide range and offer monetary security for on your own and future generations.

Verdict

In conclusion, trust fund structures play a crucial function in securing assets and ensuring economic safety and security. Professional assistance in developing and handling trust fund frameworks is necessary for long-lasting asset protection.

Report this page